New York Office Market Report & Trends, Q1 2023

New York Office Market Report & Trends, Q1 2023

Are you looking to rent a New York office?

Are you looking to rent a New York office?

With this report your businesses will gain the insights and data needed to make smart decisions when leasing an office. It provides detailed information on rental prices and availability in different parts of the city.

To optimize your budget, reliable market data is key for making the informed decisions needed for finding the perfect office space.

Contact Cogent Realty: (212) 509-4049.

Office Leasing Statistics

Office Leasing Statistics

CoStar is the world leader in commercial real estate information and has the most comprehensive database of real estate data throughout the US, Canada, UK, France, Germany, and Spain. Costar Group Inc. includes well- known brands like Loopnet, Emporis, Apartments.com, Home.com and BizBuySell.

Key Costar New York Office Building Indicators:

- Asking Rent/SF: $55.84 ↑* (*Weighted average across Manhattan office buildings.)

- Vacancy Rate: 17.9% ↑

- Inventory SF: 453M ↑

- Existing Buildings: 1,599 ↑

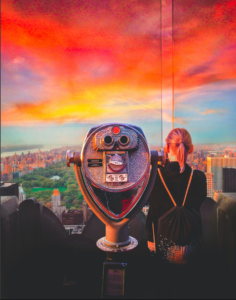

Courtesy of Lex Photography

Asking Rents in Popular Neighborhoods*

Grand Central- $57.58. 38th- 47th Street & Fifth- Second Avenue

Plaza- $64.79. 47th- 65th Street & Fifth Avenue- East River

Columbus Circle- $61.04. 50th- 65th Street & Sixth Avenue- Hudson River

Time Square- $48.62. 50th- 42nd Street & Fifth Avenue- East River

Penn Station/Fashion- $45.68. 30th- 42nd Street & Fifth Avenue- Hudson River

Murray Hill- $48.97. 38th- 30th Street & Fifth Avenue- River

U.N. Plaza- $68.76. 48th- 38th Street & Second Avenue- East River

Chelsea- $47.49. 12th- 30th Street & Fifth Avenue- Hudson River

Grammercy Park- $71.03. 12th- 30th Street & Fifth Avenue- East River

Greenwich Village- $57.02. 12th- East Houston Street & Sixth Avenue- River

Soho- $64.65. East Houston- Canal Street & Sixth Avenue- East River

Hudson Square- $46.58. 12th- Canal Street & Sixth Avenue- River

Tribeca- $74.00. Murray- Canal Street & Church Street- Hudson River

City Hall- $49.82. Canal- Vesey Street & Church Street- East River

Financial- $56.15. South Street- Maiden Lane & Broadway- East River

Insurance- $47.64. Brooklyn Bridge- Liberty Street & Broadway- East River

World Trade Center- $51.01 Murray- State Street & Broadway- Hudson River

Upper Eastside- $53.29. 110th- 65th Street & Fifth Avenue- East River

Upper Westside- n/a. Cathedral Parkway- 64th Street & Central Park West- Hudson River

Harlem/North Manhattan- $47.77. Inwood Park- 110th Street & Harlem- Hudson River

Brooklyn and Queens- $37.23 and $42.62.

*Weighted average across neighborhood office buildings.

Cogent Realty’s Perspective on the Local Marketplace

- Office Tenants continue to have an advantage when negotiating new leases and lease renewals.

- There is fierce competition among building owners to secure new business and retain existing Tenants.

- Successful companies are leasing high quality office space in amenity-rich buildings at favorable terms.

- Class A and “in demand” properties are competing by offering Tenant Incentives including rent concessions (the free rent period) and cash contributions used for the construction of new offices.

- Lower quality “commodity” properties are offering substantial rent discounts.

Workplace Trends

The Partnership for New York City surveyed 160 major Manhattan employers between January 5 and January 28, 2023 to gauge the extent to which employees have returned to the office or are still working remotely.

The Partnership for New York City surveyed 160 major Manhattan employers between January 5 and January 28, 2023 to gauge the extent to which employees have returned to the office or are still working remotely.

Key take-aways include:

- As of late January 2023, 52% of Manhattan office workers are currently at their workplace on an average weekday, up from 49% in September 2022.

- 82% of employers indicated a hybrid office schedule will be their predominant policy in 2023. For employers with a hybrid model, the survey reports that 59% of employees are in the office at least three days a week.

- Many employers expanded New York City headcounts during the pandemic and remain committed to the city: 40% increased their New York City headcount during the pandemic and 38% maintained headcount levels; only 21% decreased headcount.

- While 29% of employers have reduced their real estate footprint since February 2020, 17% increased their footprint and 54% had no change.

Commercial Real Estate News

2023 Office Market Outlook: Optimal Space Utilization Is Key

2023 Office Market Outlook: Optimal Space Utilization Is Key

REBNY’s new return-to-office gauge paints bright view for ‘trophy’ towers

REBNY’s new return-to-office gauge paints bright view for ‘trophy’ towers

Office Landlords To U.S. Government: Without Help, We’re Heading For A Financial Catastrophe

Office Landlords To U.S. Government: Without Help, We’re Heading For A Financial Catastrophe

Tallest Buildings in New York City

Tallest Buildings in New York City

Finding the Perfect Office Space is a Big Decision

Cogent Realty Advisors is an independent, licensed New York State commercial realtor founded in 2002.

Cogent Realty Advisors is an independent, licensed New York State commercial realtor founded in 2002.

•As a tenant-representation company, Cogent Realty is focused solely on representing the interests of business Tenants that rent office space.

•Tenants pay no fee for using our service.

•Cogent provides objective expertise in finding office space and negotiating lease agreements. Our experience and knowledge in the New York market means that we can secure the best office space for you with favorable terms and pricing.

For help with your office real estate, contact Mitchell Waldman: (212) 509-4049.

#NewYorkOffice