NYC Office Market Report, Third Quarter 2017

NYC Office Market Report, Third Quarter 2017

NYC Office Market Report, Third Quarter 2017 was compiled using data provided by Costar, the Commercial Real Estate Information Company.

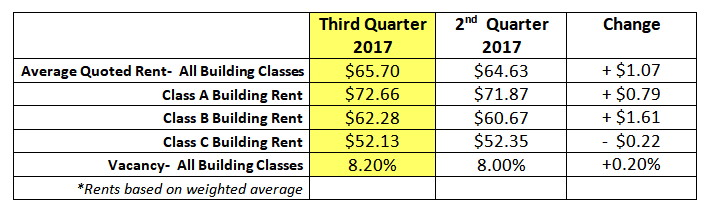

In the Third Quarter of 2017 the average quoted rent in the NYC office market across all building classes was $65.70 per square foot. This represents a $1.07 PSF increase compared to Q2. The vacancy rate in Q3 was 8.2% compared to 8.0% in Q2.

For a more recent NYC Office Market Report LINK HERE

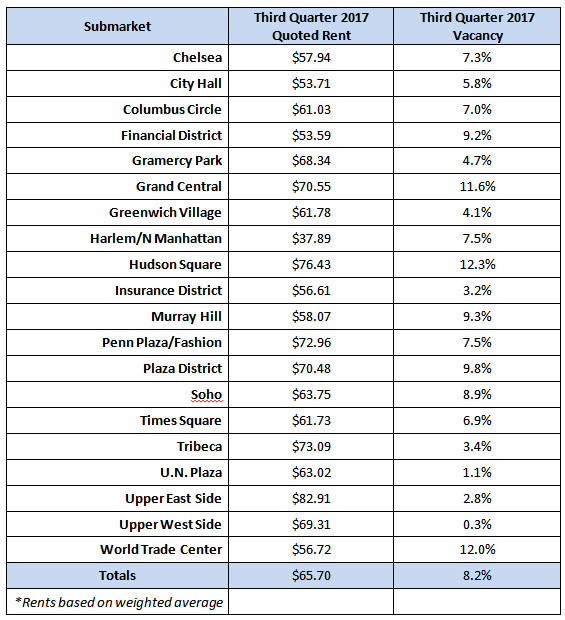

NYC Office Rents and Vacancy by Neighborhood

An analysis of the average quoted NYC office rent and vacancy by neighborhood is found in the table below.

Remarks:

• The tables above list the average quoted asking rent. Some office buildings do not publish this information.

• After lease negotiation the actual contract rent is typically lower.

• Additional Tenant Incentives for leasing space in a particular building may include: (1) A rent abatement (free rent); (2) A cash contribution provided by the Landlord for the Tenant’s construction of the office premises; and (3) The Landlord’s offer to build-to-suit the office premises.

5 Largest NYC Office Leases Signed in Q3 2017

![]() Amazon.com Inc.: 365,375 RSF at 5 Manhattan West (450 West 33rd St.) in the Penn Plaza sub-market.

Amazon.com Inc.: 365,375 RSF at 5 Manhattan West (450 West 33rd St.) in the Penn Plaza sub-market.

NYC Department of Investigation: 276,221 RSF at 180 Maiden Lane in the Financial District sub-market.

Accenture, Inc.: 248,673 RSF at 1 Manhattan West (400 West 33rd St.) in the in the Penn Plaza sub-market.

Economic Development Corp: 218,485 RSF at One Liberty Plaza in the World Trade Center sub-market.

Fragomen, Del Rey, Bernsen & Loewy LLP: 107,680 RSF at 1400 Broadway in the Penn Plaza sub-market.

Top 5 Construction Projects in the NYC Office Market

There were 15,500,149 square feet of office space under construction at the end of the third quarter of 2017.

3 World Trade Center: 2,861,402 RSF. Delivery Q1 2018. 37% preleased. Developer-Silverstein Properties, Inc.

30 Hudson Yards (500 West 33rd St.): 2,600,000 RSF. Delivery Q3 2019. 100% pre-leased. Developer- Oxford Properties Group.

1 Manhattan West (400 West 33rd St.): 2,216,609 RSF. Delivery Q1 2019. 55% pre-leased. Developer- Brookfield Office Properties, Inc.

3 Hudson Boulevard (555 West 34th St.): 1,900,000 RSF. Delivery Q2 2019. 100% pre-leased. Developer- Tishman Construction

One Vanderbilt Avenue: 1,732,955 RSF. Delivery Q3 2020. 100% pre-leased. Developer- SL Green Realty Corp.

Strategies for Reducing NYC Office Expense

(1) Space Reduction and Redesign: Businesses can reduce the size of their offices by modifying the design and reducing the area occupied by each employee. Use our office space calculator to estimate your essential requirement.

(2) Flex Work, Business Centers and Telecommuting: Flexible work schedules may allow two or more employees to utilize a specific work area. Some companies use hourly or daily rentals at off-site business centers for part-time staff and conferences. Where practical utilize telecommuting.

(3) Relocation: Consider moving from a high rent building and neighborhood to a more economical location. During the current real estate cycle many Class B and mid-block buildings have been upgraded and now provide contemporary work environments at affordable rental rates.

(3) Relocation: Consider moving from a high rent building and neighborhood to a more economical location. During the current real estate cycle many Class B and mid-block buildings have been upgraded and now provide contemporary work environments at affordable rental rates.

ABOUT COGENT REALTY ADVISORS

Cogent Realty Advisors is an independent and licensed NO FEE Realtor with over 15 years of experience representing businesses that lease NYC office space. Our goal is to help you find the right office at the right price. For information, phone Mitchell Waldman at (212) 509-4049.

#NYCOfficeReportQ32017